Insights | June 12, 2018

The new Finnish energy tax reform introduces further steps to achieve a cleaner climate and environment

On 25 May 2018, the Ministry of Finance finally announced the first the Government has decided to take steps on the long-waited reforms in energy taxes. The new legislation will enter into force in the beginning of 2019.

According to the announcement, tax on coal will be further increased and natural gas will be taxed at a lower rate. Furthermore, the double taxation of electricity on electricity storages will be removed and the tax treatment of electric vehicle charging at workplaces will be simplified. These changes in Finnish tax laws are clearly the way to a cleaner climate and support greener energy in the future.

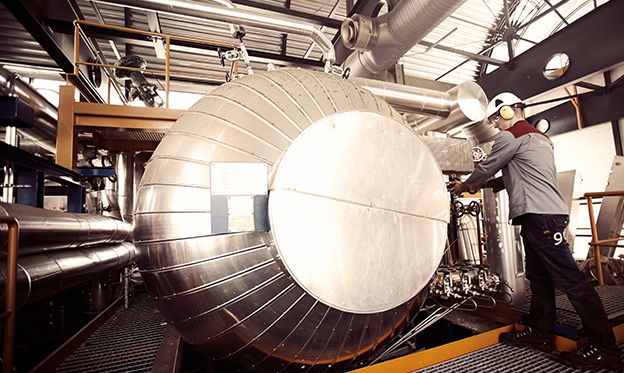

The Ministry of Finance has also started preparing reforms in the taxation of combined heat and power (CHP) generation. Currently, carbon dioxide levies for fossil fuels used in combined electricity and heat production is lowered by 50%. This would be removed as part of the reform. Also, the tax component related to energy content would be reduced. In practice, this means that tax on coal will be increased and tax on natural gas will be reduced. In the future, it may be lucrative for energy producers to replace their coal-run facilities with more climate-friendly natural gas-run facilities. We consider this to be the first stage in the implementation of the Finnish government’s objective to prohibit the use of coal in energy production by 2029.

Taxes on heating fuel would be changed to correspond to the taxes on fuel for vehicles. In the future, taxes on heating fuels will also take into account emissions from the whole life cycle of the fuel production (“well-to-wheels analyses“). Tax changes with respect to heating fuels would be implemented by means of a neutral fiscal policy.

Currently, energy storing into batteries may lead to double taxation in situations where the accumulators are first charged and then discharged through an electric network to final consumption. The issue of double taxation would be solved by removing taxes on large accumulators. At a later stage, the Ministry of Finance would consider waiving taxes on small accumulators as well, e.g. in situations where accumulators of electric vehicles are used as a means of temporary storage.

We are happy to see Finland pioneering the development of energy taxes, and we are pleased to help companies implement the new changes in their business.